This article contains affiliate links, which may earn us a commission at no extra cost to you.

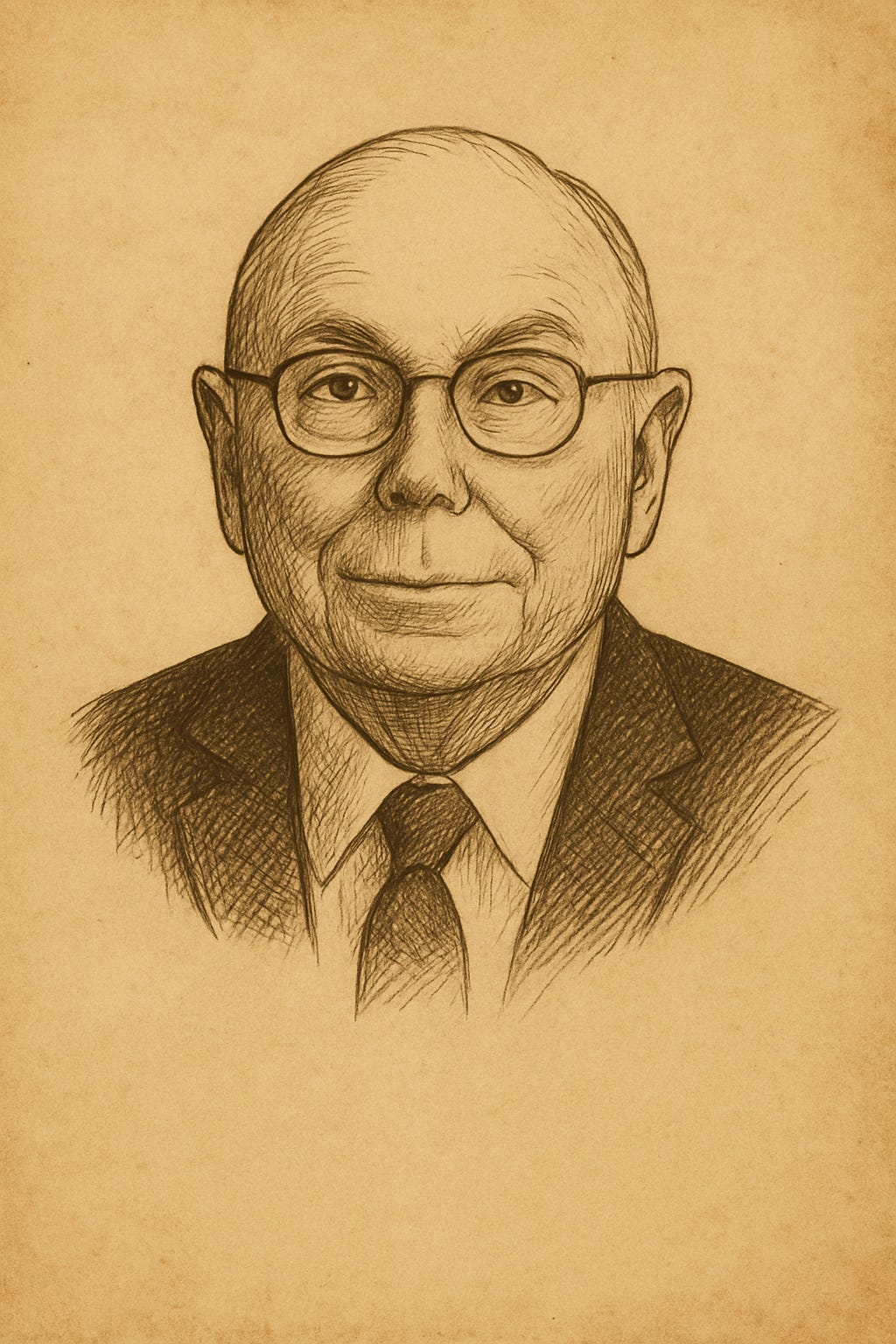

The Quiet Force Behind Berkshire Hathaway's Success

Charlie Munger, Warren Buffett’s longtime partner and vice chairman of Berkshire Hathaway, was more than just a brilliant investor—he was a philosopher of business, decision-making, and life. Through his disciplined thinking, ethical compass, and relentless pursuit of wisdom, Munger helped transform Berkshire Hathaway into a global powerhouse and left an indelible mark on generations of investors and leaders. His legacy is not merely financial; it is intellectual and moral.

From Omaha Roots to Investment Luminary

Born in Omaha, Nebraska, in 1924, Munger's early life was marked by a deep curiosity and a drive for knowledge. He served as a meteorologist during World War II before earning a law degree from Harvard. Initially practicing law, Munger soon transitioned into investing, after founding the firm Wheeler, Munger & Co. His meeting with Warren Buffett in 1959 was a pivotal moment, leading to a partnership that would redefine investment strategies. Munger's influence was instrumental in shifting Buffett's approach from buying undervalued companies to acquiring great businesses at fair prices, leading to iconic investments like Coca-Cola and American Express.

Transformative Principles and Strategic Shifts

Multidisciplinary Thinking: Munger championed the use of mental models from various disciplines—economics, psychology, engineering—to make better decisions. He believed that understanding multiple frameworks was essential for sound judgment.

Circle of Competence: He emphasized the importance of knowing one's strengths and limitations, advising individuals to operate within their areas of expertise.

Inversion Principle: Munger advocated solving problems by considering the inverse, asking, "What could cause failure?" to avoid pitfalls.

One of the most illustrative examples of Munger's strategic thinking was the acquisition of See's Candies. This investment marked a departure from the traditional "cigar butt" investing approach, showcasing the value of acquiring high-quality businesses with strong brand loyalty and pricing power. This move not only yielded substantial returns but also influenced Buffett's future investment decisions.

A Leadership Style Rooted in Rationality and Integrity

Munger's leadership was characterized by humility, integrity, and a commitment to rationality. He valued patience and long-term thinking over short-term gains. His straightforward approach often included wit and wisdom, as seen in his quip:

"All I want to know is where I'm going to die so I'll never go there."

Munger's emphasis on ethical behavior and rational decision-making set a standard in the investment community, influencing countless professionals to adopt similar principles.

Enduring Lessons for Today's Leaders

Prioritize Rational Thinking: Use multidisciplinary approaches to make informed decisions.

Understand Your Limits: Operate within your circle of competence to avoid costly mistakes.

Think Long-Term: Focus on enduring value rather than short-term profits.

Embrace Continuous Learning: Cultivate a habit of reading and self-education.

Practice Inversion: Identify and avoid potential failures by considering the opposite perspective.

These principles are not only applicable in investing but also serve as valuable guidelines for decision-making in various aspects of life and business.

A Legacy That Continues to Inspire

Munger's principles continue to influence investors, business leaders, and thinkers worldwide. His emphasis on rationality, ethics, and lifelong learning serves as a guiding framework for decision-making in various fields. Even after his passing in 2023, his teachings remain integral to Berkshire Hathaway's philosophy and the broader investment community.

Recommended Reading

Charlie was a staunch believer in continuous learning, stating:

"In my whole life, I have known no wise people who didn't read all the time—none, zero."

Poor Charlie's Almanack by Charles T. Munger (hardcover / kindle)

Charlie Munger: The Complete Investor by Tren Griffin (hardcover / paperback / kindle)

Damn Right!: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger by Janet Lowe (hardcover / paperback / kindle)

What Makes Charlie a Prime Mover?

Charlie Munger exemplified the role of a Prime Mover—not through flamboyance, but through steadfast commitment to principles, intellectual rigor, and ethical leadership. His life teaches us that success is built on a foundation of knowledge, patience, and integrity. As we navigate our own paths, Munger's wisdom offers a compass for thoughtful and principled decision-making.